The Ultimate Guide to EMI Calculators: Home Loan, Personal Loan & Interest Calculations

Planning a home purchase or personal loan? Understanding your Equated Monthly Installments (EMIs) is crucial for financial planning. In this comprehensive guide, we’ll explore house loan EMI calculators, personal loan interest calculators, and tools to help you make informed borrowing decisions.

What is an EMI Calculator?

An EMI interest calculator is a digital tool that computes your monthly loan repayments based on:

- Principal loan amount

- Interest rate (%)

- Loan tenure

Our built-in calculator below helps calculate EMIs for:

✅ Home Loans

✅ Personal Loans

✅ Car Loans

✅ Education Loans

Types of EMI Calculators

1. Home Loan EMI Calculator

Perfect for: Home buyers, property investors

Key Features:

- Calculates monthly payments for house loans

- Shows interest vs principal breakup

- Helps compare 15-year vs 30-year mortgages

Pro Tip: Use our home loan EMI calculator to see how a ₹50 lakh home loan at 8.5% interest translates to ₹42,768/month over 20 years.

2. Personal Loan EMI Calculator

Best for: Emergency funds, weddings, travel

Advantages:

- Instant personal loan EMI estimates

- Compare interest rates across banks

- Plan short-term (1-5 year) repayments

Example: A ₹5 lakh personal loan at 12% interest for 3 years = ₹16,607/month (calculated using our personal loan interest calculator).

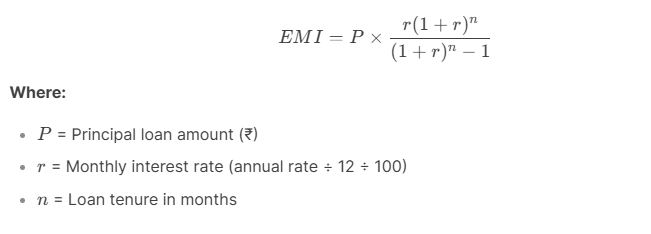

How EMI Calculators Work: The Formula Behind the Numbers

All EMI interest calculators use this standard formula:

Key Factors Affecting Your EMI:

- Loan Amount: Higher principal = Larger EMIs

- Interest Rate: 1% increase can raise EMIs by 10-15%

- Tenure: Longer durations reduce monthly payments but increase total interest

5 Benefits of Using an EMI Calculator

- Accurate Repayment Forecasts

Avoid payment shocks with precise monthly estimates - Interest Savings Strategies

Identify how extra payments reduce total interest - Loan Comparison Made Easy

Compare 10+ bank offers in minutes - Tenure Optimization

Balance between affordable EMIs and total interest paid - Financial Planning

Create budgets that account for loan obligations

How to Use Our EMI Calculator (Step-by-Step)

- Enter Loan Amount

- Home loans: ₹30 lakh to ₹5 crore

- Personal loans: ₹50,000 to ₹50 lakh

- Input Interest Rate

- Current home loan rates: 8.4%-9.5% p.a.

- Personal loan rates: 10.5%-24% p.a.

- Select Tenure

- Home loans: 5-30 years

- Personal loans: 6 months-5 years

- Get Instant Results

- Monthly EMI amount

- Total interest payable

- Detailed amortization schedule

EMI Calculation Examples

| Loan Type | Amount | Rate | Tenure | Monthly EMI |

|---|---|---|---|---|

| Home Loan | ₹75 lakh | 8.5% | 20 years | ₹65,327 |

| Personal Loan | ₹10 lakh | 12% | 5 years | ₹22,244 |

| Education Loan | ₹25 lakh | 9% | 10 years | ₹31,682 |

Calculations made using our advanced EMI interest calculator

FAQs: EMI Calculators

Q1. How accurate are online EMI calculators?

Our tools provide bank-level accuracy (±₹50 variance due to rounding).

Q2. Does checking EMI affect credit score?

No – our calculator doesn’t require personal details or credit checks.

Q3. How to reduce EMIs?

- Opt for longer tenures

- Improve credit score for better rates

- Make down payments

Optimize Your Loans Today

Whether you’re using a house loan EMI calculator to plan your dream home or a personal loan EMI calculator for urgent needs, understanding your repayment strategy is key to financial health.

Try Our Calculator Now →